The Best Turbotax 2018 Premier Desktop

Nowadays, there are so many products of turbotax 2018 premier desktop in the market and you are wondering to choose a best one.You have searched for turbotax 2018 premier desktop in many merchants, compared about products prices & reviews before deciding to buy them.

You are in RIGHT PLACE.

Here are some of best sellings turbotax 2018 premier desktop which we would like to recommend with high customer review ratings to guide you on quality & popularity of each items.

637 reviews analysed

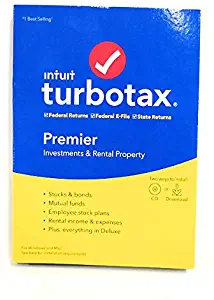

TurboTax Premier + State 2019 Tax Software [Amazon Exclusive] [PC/Mac Disc]

- TurboTax Premier + State is recommended if you sold stocks, bonds, mutual funds or options for an employee stock purchase plan, own rental property or you are the beneficiary of an estate or trust (received a K 1 form)

- With Premier, retirement tax help and the IRA tool show you how to get more money back this year and when you retire. Keep more of your investment and rental income. Get your taxes done right and tailored to you, based on your unique situation.

- MAXIMUM TAX REFUND – Searches for more than 350+ tax deductions and credits, including mortgage interest, property taxes and energy-efficient improvements, to get you everything you deserve

- TAXES DONE RIGHT – TurboTax guides you through your tax preparation, keeping you up to date with the latest tax laws and double checking your entries along the way.

- SAVE TIME- Automatically imports financial information including W-2s, mortgage and investment information as well as imports prior year tax return information from TurboTax and other tax software.

- Includes 5 free federal e-files and one download of a TurboTax state product ($44.99 value) state e-file sold separately

- Exclusively at Amazon, receive a free 1 year subscription to Quicken Starter Edition ($34.95 value) with your purchase of TurboTax

- Free U.S. based TurboTax product support via phone

- TRACK YOUR DONATIONS with Its Deductable from TurboTax- Turn charitable donations into big tax deductions

TurboTax Premier is recommended if you sold stocks, bonds, mutual funds or options for an employee stock purchase plan, own rental property or you are the beneficiary of an estate or trust (received a K-1 form). TurboTax is tailored to your unique situation-it will search for the deductions and credits you deserve, so you’re confident you’ll get your maximum refund • TurboTax coaches you every step of the way and double checks your return as you go to handle even the toughest tax situations, so you can be confident you’re getting every dollar you deserve. • Every year it gets even easier. As a returning customer, TurboTax will automatically transfer last year’s data to help ensure accuracy and save you time • Up-to-date with the latest tax laws-so you can be confident your taxes will be done right. • Help along the way-get answers to your product questions, so you won’t get stuck. • Your information is safeguarded – TurboTax uses encryption technology, so your tax data is protected while it’s e-filed to IRS and state agencies

TurboTax Tax Software Deluxe + State 2019 [Amazon Exclusive] [PC Download]

- Turbotax deluxe + state is recommended if you own your own home, donated to charity, have significant education or medical expenses, have child related expenses or have a lot of deductions and need to file a federal and/or state income tax return

- Deluxe + state will accurately deduct mortage interest and propery taxes

- Get your taxes done right and tailored to you, based on your unique situation

- Maximum tax refund: Searches for more than 350+ tax deductions and credits, including mortgage interest, property taxes and energy efficient improvements, to get you everything you deserve

- Taxes done right: Turbotax guides you through your tax preparation, keeping you up to date with the latest tax laws and double checking your entries along the way

- Save time: Automatically imports financial information including w 2s and mortgage information as well as imports prior year tax return information from turbotax and other tax software

- Includes 5 free federal e files and one download of a turbotax state product ($44.99 value) state e file sold separately

- Exclusively at Amazon, receive a free 1 year subscription to quicken starter edition 2019 ($29.99 value) with your purchase of turbotax

- Free U.S. Based turbotax product support via phone

- Track your donations with its deductable from turbotax turn charitable donations into big tax deductions

TurboTax Deluxe is recommended if you own your own home, donated to charity, have significant education or medical expenses, have child-related expenses or have a lot of deductions TurboTax is tailored to your unique situation-it will search for the deductions and credits you deserve, so you’re confident you’ll get your maximum refund

• TurboTax coaches you every step of the way and double checks your return as you go to handle even the toughest tax situations, so you can be confident you’re getting every dollar you deserve.

• Every year it gets even easier. As a returning customer, TurboTax will automatically transfer last year’s data to help ensure accuracy and save you time

• Up-to-date with the latest tax laws-so you can be confident your taxes will be done right.

• Help along the way-get answers to your product questions, so you won’t get stuck.

• Your information is safeguarded – TurboTax uses encryption technology, so your tax data is protected while it’s e-filed to IRS and state agencies

TurboTax Tax Software Deluxe + State 2019 [Amazon Exclusive] [Mac Download]

- Turbotax deluxe + state is recommended if you own your own home, donated to charity, have significant education or medical expenses, have child related expenses or have a lot of deductions and need to file a federal and/or state income tax return

- Deluxe + state will accurately deduct mortage interest and propery taxes

- Get your taxes done right and tailored to you, based on your unique situation

- Maximum tax refund: Searches for more than 350+ tax deductions and credits, including mortgage interest, property taxes and energy efficient improvements, to get you everything you deserve

- Taxes done right: Turbotax guides you through your tax preparation, keeping you up to date with the latest tax laws and double checking your entries along the way

- Save time: Automatically imports financial information including w 2s and mortgage information as well as imports prior year tax return information from turbotax and other tax software

- Includes 5 free federal e files and one download of a turbotax state product ($44.99 value) state e file sold separately

- Exclusively at Amazon, receive a free 1 year subscription to quicken starter edition 2019 ($29.99 value) with your purchase of turbotax

- Free U.S. Based turbotax product support via phone

- Track your donations with its deductable from turbotax turn charitable donations into big tax deductions

TurboTax Deluxe is recommended if you own your own home, donated to charity, have significant education or medical expenses, have child-related expenses or have a lot of deductions TurboTax is tailored to your unique situation-it will search for the deductions and credits you deserve, so you’re confident you’ll get your maximum refund

• TurboTax coaches you every step of the way and double checks your return as you go to handle even the toughest tax situations, so you can be confident you’re getting every dollar you deserve.

• Every year it gets even easier. As a returning customer, TurboTax will automatically transfer last year’s data to help ensure accuracy and save you time

• Up-to-date with the latest tax laws-so you can be confident your taxes will be done right.

• Help along the way-get answers to your product questions, so you won’t get stuck.

• Your information is safeguarded – TurboTax uses encryption technology, so your tax data is protected while it’s e-filed to IRS and state agencies

TurboTax Premier + State 2019 Tax Software [Amazon Exclusive] [PC Download]

- TurboTax Premier + State is recommended if you sold stocks, bonds, mutual funds or options for an employee stock purchase plan, own rental property or you are the beneficiary of an estate or trust (received a K 1 form)

- With Premier, retirement tax help and the IRA tool show you how to get more money back this year and when you retire. Keep more of your investment and rental income. Get your taxes done right and tailored to you, based on your unique situation.

- MAXIMUM TAX REFUND – Searches for more than 350+ tax deductions and credits, including mortgage interest, property taxes and energy-efficient improvements, to get you everything you deserve

- TAXES DONE RIGHT – TurboTax guides you through your tax preparation, keeping you up to date with the latest tax laws and double checking your entries along the way.

- SAVE TIME- Automatically imports financial information including W-2s, mortgage and investment information as well as imports prior year tax return information from TurboTax and other tax software.

- Includes 5 free federal e-files and one download of a TurboTax state product ($44.99 value) state e-file sold separately

- Exclusively at Amazon, receive a free 1 year subscription to Quicken Starter Edition ($34.95 value) with your purchase of TurboTax

- Free U.S. based TurboTax product support via phone

- TRACK YOUR DONATIONS with Its Deductable from TurboTax- Turn charitable donations into big tax deductions

TurboTax Premier is recommended if you sold stocks, bonds, mutual funds or options for an employee stock purchase plan, own rental property or you are the beneficiary of an estate or trust (received a K-1 form). TurboTax is tailored to your unique situation-it will search for the deductions and credits you deserve, so you’re confident you’ll get your maximum refund

• TurboTax coaches you every step of the way and double checks your return as you go to handle even the toughest tax situations, so you can be confident you’re getting every dollar you deserve.

• Every year it gets even easier. As a returning customer, TurboTax will automatically transfer last year’s data to help ensure accuracy and save you time

• Up-to-date with the latest tax laws-so you can be confident your taxes will be done right. • Help along the way-get answers to your product questions, so you won’t get stuck.

• Your information is safeguarded – TurboTax uses encryption technology, so your tax data is protected while it’s e-filed to IRS and state agencies

TurboTax Premier + State 2019 Tax Software [Amazon Exclusive] [Mac Download]

- TurboTax Premier + State is recommended if you sold stocks, bonds, mutual funds or options for an employee stock purchase plan, own rental property or you are the beneficiary of an estate or trust (received a K 1 form)

- With Premier, retirement tax help and the IRA tool show you how to get more money back this year and when you retire. Keep more of your investment and rental income. Get your taxes done right and tailored to you, based on your unique situation.

- MAXIMUM TAX REFUND – Searches for more than 350+ tax deductions and credits, including mortgage interest, property taxes and energy-efficient improvements, to get you everything you deserve

- TAXES DONE RIGHT – TurboTax guides you through your tax preparation, keeping you up to date with the latest tax laws and double checking your entries along the way.

- SAVE TIME- Automatically imports financial information including W-2s, mortgage and investment information as well as imports prior year tax return information from TurboTax and other tax software.

- Includes 5 free federal e-files and one download of a TurboTax state product ($44.99 value) state e-file sold separately

- Exclusively at Amazon, receive a free 1 year subscription to Quicken Starter Edition ($34.95 value) with your purchase of TurboTax

- Free U.S. based TurboTax product support via phone

- TRACK YOUR DONATIONS with Its Deductable from TurboTax- Turn charitable donations into big tax deductions

TurboTax Premier is recommended if you sold stocks, bonds, mutual funds or options for an employee stock purchase plan, own rental property or you are the beneficiary of an estate or trust (received a K-1 form). TurboTax is tailored to your unique situation-it will search for the deductions and credits you deserve, so you’re confident you’ll get your maximum refund

• TurboTax coaches you every step of the way and double checks your return as you go to handle even the toughest tax situations, so you can be confident you’re getting every dollar you deserve.

• Every year it gets even easier. As a returning customer, TurboTax will automatically transfer last year’s data to help ensure accuracy and save you time

• Up-to-date with the latest tax laws-so you can be confident your taxes will be done right. • Help along the way-get answers to your product questions, so you won’t get stuck.

• Your information is safeguarded – TurboTax uses encryption technology, so your tax data is protected while it’s e-filed to IRS and state agencies

TurboTax Home & Business + State 2019 Tax Software [Amazon Exclusive] [PC Download]

- Turbotax home & business + state is recommended to maximize your deductions for personal and self employed tax situations especially if you received income from a side job

- Best for those who are self employed or an independent contractor, freelancer, consultant or sole proprietor

- Maximum tax refund searches for more than 350+ tax deductions and credits, including mortgage interest, property taxes and energy efficient improvements, to get you everything you deserve

- Taxes done right: Turbotax guides you through your tax preparation, keeping you up to date with the latest tax laws and double checking your entries along the way

- Save time: Automatically imports financial information including w 2s and mortgage information as well as imports prior year tax return information from turbotax and other tax software

- Includes 5 free federal E files and one download of a turbotax state product ($44.99 value) state e file sold separately

- Exclusively at Amazon, receive a free 1 year subscription to quicken starter edition 2019 ($29.99 value) with your purchase of turbotax

- Free U.S. Based turbotax product support via phone

- Track your donations with its deductable from turbotax turn charitable donations into big tax deductions

TurboTax Home & Business is recommended if you received income from a side job or are self-employed, an independent contractor, freelancer, consultant or sole proprietor, you prepare W-2 and 1099 MISC forms for employees or contractors, you file your personal and self-employed tax together (if you own an S Corp, C Corp, Partnership or multiple-owner LLC, choose TurboTax Business). TurboTax is tailored to your unique situation-it will search for the deductions and credits you deserve, so you’re confident you’ll get your maximum refund

• TurboTax coaches you every step of the way and double checks your return as you go to handle even the toughest tax situations, so you can be confident you’re getting every dollar you deserve.

• Every year it gets even easier. As a returning customer, TurboTax will automatically transfer last year’s data to help ensure accuracy and save you time

• Up-to-date with the latest tax laws-so you can be confident your taxes will be done right. • Help along the way-get answers to your product questions, so you won’t get stuck.

• Your information is safeguarded – TurboTax uses encryption technology, so your tax data is protected while it’s e-filed to IRS and state agencies

TurboTax 2019, Premier Federal Efile, for PC/Mac

TURBOTAX PREMIER 2019

Intuit TurboTax Home & Business 2018 Tax Preparation Software

- TurboTax Home & Business is recommended if you received income from a side job or are self employed, an independent contractor, freelancer, consultant or sole proprietor, you prepare W 2 and 1099 MISC forms for employees or contractors, you file your personal and self employed tax together (if you own an S Corp, C Corp, Partnership or multiple owner LLC, choose TurboTax Business)

- Get your personal and self employed taxes done right

- Up to date with the latest tax laws

- Extra guidance for self employment & business deductions

- Includes 5 free federal e files and one download of a TurboTax state product (state e file sold separately)

Platform: Mac/PC Disk

Amazon.com

TurboTax Home & Business is recommended if you received income from a side job or are self employed, an independent contractor, freelancer, consultant or sole proprietor, you prepare W 2 and 1099 MISC forms for employees or contractors, you file your personal and self employed tax together (if you own an S Corp, C Corp, Partnership or multiple owner LLC, choose TurboTax Business). TurboTax is tailored to your unique situation it will search for the deductions and credits you deserve, so you’re confident you’ll get your maximum refund. TurboTax coaches you every step of the way and double checks your return as you go to handle even the toughest tax situations, so you can be confident you’re getting every dollar you deserve. Every year it gets even easier. As a returning customer, TurboTax will automatically transfer last year’s data to help ensure accuracy and save you time.

From the Manufacturer

Get your taxes done right with TurboTax

TurboTax Home and Business is recommended if any of the following apply:

- You are self-employed, independent contractor, freelancer, consultant, or a sole proprietor

- You receive income from a side job

- You prepare W-2 & 1099-MISC forms for employees/contractors

- You file personal & self-employed taxes together

TurboTax is tailored to your unique situation – it will search for the deductions & credits you deserve, so you’re confident you’ll get your maximum refund.

- TurboTax guides you every step of the way and double checks your return to handle the toughest tax situations

- Jumpstart your tax return with last year’s TurboTax info to help ensure accuracy and save you time

- Up-to-date with the latest tax laws – so you can be confident your taxes will be done right

TurboTax Premier Federal + State + Federal efile 2009

- TurboTax Premier guides you step-by-step through investments and rental property income

- Assists with stocks, bonds, mutual funds and employee stock plans

- Provides extra guidance for rental property income, expenses and refinancing

- Free Federal E-File—receive IRS confirmation and get your refund in as few as 8 days

- Plus, includes a download of one TurboTax State product–a $39.95 value

Product Description

TurboTax Premier Federal State

Amazon.com

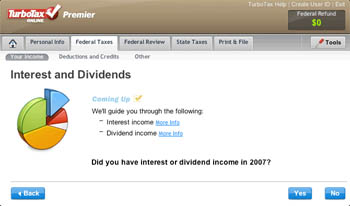

If you own stocks, bonds, mutual funds or rental properties, TurboTax Premier makes it easy to keep more money in your pocket.

Get Your Refund Fast: Efile Your 2009 Taxes with TurboTax |

Here’s how it works:

Asks easy questions

We customize questions to your unique situation, transfer your info from last year, and put it all on the right tax forms for you.

Maximizes deductions

We search for more than 350 deductions to get you the biggest refund possible

guaranteed.

Efile for a fast refund

Efile with direct deposit to get your refund in as few as 8 days. Five federal efiles included. Prepare and print unlimited single state filings. Additional state forms and state e-file are available for an additional charge.

Why TurboTax Premier is the easiest choice for you

TurboTax Premier was designed to help you make the most of your investments and rental property deductions, so you get the biggest tax refund possible.

Choose TurboTax Premier if any of the following apply to you:

- You sold stocks, bonds, mutual funds, or options for an employee stock plan

- You own rental property

- You are the beneficiary of an estate or trust (received a K-1 form)

If you are a sole proprietor, consultant, 1099 contractor, or single-owner LLC, choose TurboTax Home & Business. It has everything in Premier, PLUS expanded guidance to help you maximize home office, vehicle, and other business deductions.

Compare TurboTax Software

Helps You Get the Most from Your Investments

TurboTax customizes questions to your unique situation, transfer your info from last year, and put it all on the right tax forms for you. Click to enlarge. |

TurboTax searches for more than 350 deductions to get you the biggest refund possible–guaranteed. Click to enlarge. |

Exclusive–Imports Your Investment Info

Saves time by automatically importing your investment info directly from your financial institution.

Helps You Accurately Report Investment Sales

Walks you through reporting sales of stocks, bonds and mutual funds. Automatically calculates capital gains/losses and keeps track of those that carry over to future tax returns.

Determines Your Cost Basis

Finds your accurate purchase price for stock sales, in three easy steps.

Helps with Employee Stock Plans

Guides you through reporting sales and automatically determines your correct basis for selling shares purchased at different times or different prices.

401(k) Maximizer

Shows you how to increase your 401(k) contribution without decreasing your take-home pay.

Exclusive–Helps You Find Every Rental Deduction

Finds over 20 deductions for landlords, from travel to advertising to repairs to insurance.

Exclusive–Shows Your Best Rental Depreciation Method

Simplifies reporting rental property depreciation and shows which depreciation method will get you the biggest tax deduction.

Maximizes Refinancing Deductions

Guides you through deducting points, appraisal fees, recording costs, and more so you don’t miss a single chance to save.

Helps with New Rental Properties

Shows you step by step how to set up new rental properties.

Finds All Deductions and Credits You Deserve to Get Your Biggest Refund

Stimulus Ready

Updated with all of the latest tax laws to help you get all of the deductions and credits you deserve–including the new 2009 Stimulus Plan credits for homebuyers, new car purchases and more.

Maximizes Your Tax Deductions

Asks simple questions about your income, family situation and changes in your tax situation and credits. Then, based on your answers, searches for more than 350 deductions and credits to get you the biggest tax refund–guaranteed.

Looks for Deduction Opportunities as You Go

Shows you which deductions you’ve taken. Which deductions you haven’t. And tells you how to qualify for just about any deduction, so you don’t miss any opportunities to save.

Gets You the Maximum Deduction for Donations

ItsDeductible (included) helps you accurately value items you donate to charity–no more guessing. Plus, it tracks other donations such as cash, mileage and stocks, to help you get every charitable deduction you’re entitled to.

Handles Your Life Changes

Changed jobs? Got married? Bought a home? Had a baby? TurboTax guides you through common life changes, explains how the changes will impact your taxes, and tells you what you can deduct.

Helps with Medical Expenses

Does all the math and tells you if you qualify to deduct your medical expenses for maximum tax savings.

|

Includes Downloadable Audit Support Center Only about 1% of all personal tax returns were audited, so it is unlikely, but if you are contacted by the IRS, we’ll help you to:

|

|

| With downloadable step-by-step guidance, including what different types of IRS letters may mean, you’ll know exactly where you stand and what to do next.

Remember, TurboTax guarantees 100% accurate calculations. If you pay an IRS penalty or interest because of a TurboTax calculation error, we’ll pay you the penalty and interest. |

|

Helps You Reduce Audit Risk

Tracks Your Audit Risk

Audit Risk Meter checks your tax return for common audit triggers. Shows whether your risk is high or low. And provides tips to help you reduce your chance of an audit.

Includes Downloadable Audit Support Center

Gives you step-by-step guidance on everything you need to know and do if the IRS contacts you.

Also Available: Audit Defense

Provides full-service representation by a trained tax professional. You will never have to meet with the IRS, unless you want to.3

Does the Hard Work for You

Asks Easy Questions, Tailored to You

Guides you step by step through your tax return and puts your answers on the right tax forms for you. Skips interview questions that don’t apply to you, so you can finish your return faster.

Improved Automatically Fills in W-2 and 1099 Info

Gets your W-2 and 1099 data directly from over 100,000 participating employers and financial institutions and automatically puts it in the right tax forms. A brief summary lets you review and edit downloaded information if necessary.

Improved Transfers Last Year’s Tax Info

No retyping necessary. Fills in information from your previous year’s return to save time and increase accuracy. Shows you what you’re importing and where it goes in your return. You can also import from other tax software including TaxACT and H&R Block’s TaxCut.

Imports Your Financial Data

Imports information from your financial software (including Quicken, QuickBooks 2007 and higher, and Microsoft Money) so you can skip the cut and paste this year.

New–Makes it Easy to Hold Your Place

Flag areas in your tax return so you can get back to them easily.

Provides Help and Advice When You Need It

Live Tax Answers

Get live answers online from TurboTax experts and other TurboTax users in our Live Community. Plus you’ll have instant access to answers to commonly asked tax questions on every screen.

Straightforward Guidance & Advice

Find help on any tax topic from anywhere within TurboTax. Get plain-English explanations of specific tax areas and helpful examples when you need them.

Guide Me

Not sure how to answer a tax question? We’ll guide you to the right answer, making your taxes even easier.

Explains Your Return

Shows you a summary of your return, including income, tax, credits and payments so you know your taxes are accurate. Provides recommendations to help you get an even bigger refund next year.

FREE Technical Support

Got a software question? No problem! Get answers from a TurboTax expert via e-mail, phone, or live chat.

Spots Errors and Shows How to Fix Them

New–Smart Check Scans for Mistakes

Smart Check double-checks your return for errors, so you can be confident your taxes are done right.

Guaranteed Accurate Calculations

If you should get hit with an IRS or state penalty or interest due to a TurboTax calculation error, we’ll pay you the penalty and interest.

Keeps You Up-to-Date with the Latest Tax Laws

With a single click you can check for updates each time you start to ensure your return includes the latest IRS and state tax forms. No more disruptions while you work on your return.

Get Your Refund Faster with Included Federal Efile

Shows Your Tax Refund in Real Time

Watch your refund add up as you complete your return. Our Dual Refund Monitor constantly displays and updates both your federal and state refunds (or taxes due) as you complete your federal return.

Federal Efile Included

Get your refund in as few as 8 days with efile and direct deposit. Free federal efile is included with TurboTax at no extra charge. If you’re a returning user, we’ll automatically transfer your efile information from your previous year’s return to save you even more time.

TurboTax Premier Includes These Tax Forms

TurboTax takes the worry out of deciding which forms you need to file. Just answer simple questions and TurboTax fills out the right forms for you.

Most Commonly-Filed IRS Tax Forms and Schedules

| Form 1040 | Individual Income Tax Return |

| Schedule A | Itemized Deductions |

| Form 1040A | Individual Income Tax Return |

| Schedule B | Interest and Dividend Income |

| Schedule D/D-1 | Capital Gains and Losses/Additional Capital Gains and Losses |

| Form 1040EZ | Income Tax Return for Single and Joint Filers With No Dependents |

| Schedule C/EZ | Profit (or Loss) from Business/Net Profit from Business |

| Schedule EIC | Earned Income Credit |

| Schedule E | Supplemental Income and Loss |

| Schedule SE | Self-Employment Tax |

Other Tax Forms and Schedules

| Schedule F | Profit or Loss from Farming |

| Schedule H | Household Employment Taxes |

| Schedule J | Income Averaging for Farmers and Fishermen |

| Schedules K-1 Worksheet (Form 1041) | Estates and Trusts |

| Schedules K-1 (Form 1065) | Partner’s Share of Income, Credits, Deductions |

| Schedules K-1 (Form 1120S) | Shareholder’s Share of Income, Credits, etc |

| Schedule R | Credit for Elderly or Disabled |

| Schedule 1 – 1040A | Interest and Ordinary Dividends for Form 1040A Filers |

| Schedule 2 – 1040A | Child and Dependent Care Expenses |

| Schedule 3 – 1040A | Credit for Elderly or Disabled |

| Form 982 | Reduction of Tax Attributes Due to Discharge of Indebtedness |

| Form 982WKS | Cancellation of Debt Worksheet |

| Form 1040-ES | Estimated Tax for Individuals |

| Form 1040-V | Payment Vouchers |

| Form 1040X | Amended U.S. Individual Income Tax Return |

| Form 1098T | Tuition Statement |

| Form 1099-MISC | Miscellaneous Income |

| Form 1099-Q | Payments From Qualified Education Programs |

| Form 1099-R | Distributions From Pensions, Annuities, Retirement, etc. |

| Form 1116 | Foreign Tax Credit |

| Form 1116 AMT | Foreign Tax Credit for AMT |

| Form 1310 | Statement of Person Claiming Refund Due a Deceased Taxpayer |

| Form 2106/EZ | Employee Business Exp/EZ Employee Business Expenses Short Form |

| Form 2119 | Home Sale Worksheet |

| Form 2120 | Multiple Support Declaration |

| Form 2210/2210AI | Underpayment of Tax/Annualized Income |

| Form 2210F | Underpayment of Estimated Tax by Farmers |

| Form 2439 | Notice to Shareholder of Undistributed Long-Term Capital Gains |

| Form 2441 | Child and Dependent Care Expenses |

| Form 2555 | Foreign Earned Income |

| Form 3468 | Investment Credit |

| Form 3800 | General Business Credit |

| Form 3903 | Moving Expenses |

| Form 4136 | Credit for Federal Tax Paid on Fuels |

| Form 4137 | Tax on Unreported Tips |

| Form 4255 | Recapture of Investment Credit |

| Form 4506 | Request for Copy of Tax Form |

| Form 4562 | Depreciation and Amortization |

| Form 4684 | Casualties and Theft |

| Form 4797 | Sales of Business Property |

| Form 4835 | Farm Rental Income and Expenses |

| Form 4852 | Substitute W-2 or 1099-R |

| Form 4868 | Application for Automatic Extension of Time to File |

| Form 4952/AMT | Investment Interest Expense Deduction/Investment Interest Expense Deduction – AMT |

| Form 4972 | Tax on Lump-Sum Distributions |

| Form 5329 | Additional Taxes on Retirement Plans |

| Form 5405 | First-Time Homebuyer Credit |

| Form 5695 | Residential Energy Credits |

| Form 6198 | At-Risk Limitations |

| Form 6251 | Alternative Minimum Tax |

| Form 6252 | Installment Sale Income |

| Form 6781 | Gains/Losses from Section 1256 Contracts and Straddles |

| Form 8283 | Non-cash Charitable Contributions |

| Form 8332 | Release of Claim to Exemption for Child of Divorced of Separated Parents |

| Form 8379 | Injured Spouse Claim and Allocation |

| Form 8396 | Mortgage Interest Credit |

| Form 8453 | U.S. Individual Income Tax Transmittal for an IRS E-File Return |

| Form 8582/AMT/CR | Passive Activity Loss Limitations/AMT/Credit Limitations |

| Form 8586 | Low Income Housing Credit |

| Form 8606 | Nondeductible IRAs |

| Form 8615 | Tax for Certain Children Who Have Investment Income of More Than $1,800 |

| Form 8801 | Credit for Prior Year Minimum Tax |

| Form 8812 | Additional Child Tax Credit |

| Form 8814 | Parent’s Election To Report Child’s Interest and Dividends |

| Form 8815 | Exclusion of Interest from Series EE and I Bonds |

| Form 8822 | Change of Address |

| Form 8824 | Like-Kind Exchange |

| Form 8829 | Business Use of Your Home |

| Form 8839 | Qualified Adoption Expenses |

| Form 8853 | Archer MSAs and Long-Term Care Insurance Contracts |

| Form 8857 | Innocent Spouse Relief |

| Form 8859 | DC First-Time Homebuyer Credit |

| Form 8862 | Info to Claim EIC After Disallowance |

| Form 8863 | Education Credits |

| Form 8880 | Credit for Qualified Retirement Savings Contributions |

| Form 8881 | Credit for Small Employer Pension Plan Startup Costs |

| Form 8885 | Health Coverage Tax Credit |

| Form 8888 | Direct Deposit of Refund |

| Form 8889 | Health Savings Account |

| Form 8891 | Canadian Retirement Plans |

| Form 8903 | Domestic Production Activities Deduction |

| Form 8910 | Alternative Motor Vehicle Credit |

| Form 8914 | Exemption for Taxpayers Housing Individuals Displaced by Midwestern Disasters |

| Form 8915 | Hurricane Retirement Plan Distributions |

| Form 8917 | Tuition and Fees Deduction |

| Form 8919 | Uncollected Social Security and Medicare Tax on Wages |

| Form 8930 | Midwestern Disaster Area Distributions |

| Form 9465 | Installment Agreement Request |

| Form SS-4 | Application for Employer ID Number |

| Form TD F 90-22.1 | Report of Foreign Bank Accounts |

| Form W-4 | Employee’s Withholding Allowance Certificate |

| Form W-2 | Wages and Tax Statement |

Choose Security. Choose TurboTax.

TurboTax is dedicated to protecting your personal and financial information. From the most advanced technology to our dedicated Privacy Team, we have you covered.

In fact, TRUSTe, the leading Internet privacy seal-of-approval, named Intuit as one of three Most Trusted Companies for Privacy for 2007.

Our Site Is Tested Daily for Security

To support our commitment to protect your confidential data, the TurboTax Web site is tested and certified daily by the third-party McAfee HACKER SAFE Security Scan, an industry leader in Web site security.

Only You Can Access Your Return

TurboTax Online requires a unique log in. Once you create your username and password, your tax return is guarded. Rest assured that you have complete control over who sees your personal information.

TurboTax CDs and downloads store your information right on your computer. You can choose your own password to protect your personal information.

Your Information Travels Safely

Your TurboTax session is secure. TurboTax Online shields your personal information from prying eyes while you’re completing your return.

TurboTax uses the same encryption technology used by banks to efile your return. This means that your information is protected from any unauthorized access while it’s electronically sent to the IRS and state agencies.

Our Commitment to You

Armed with surveillance cameras and security alarms, the TurboTax Security Team physically protects our computers and your information–24 hours a day, 7 days a week.

Our Privacy Team’s only job is to guard you and your information. If you feel the least bit uneasy, ask the Privacy Team about their commitment to your protection.

2016 Intuit Turbotax Premier 2016 [OLD VERSION] Federal andState Fed Efile PC/MAC Disc- Old Version For 2016 Taxes Only

- Note: NOT for 2018 taxes…this is for for 2016 taxes

- Original tax filing for this product: April 15th 2017

- Specialized Guidance For Handling Your Stocks, Bonds, Etc

- Includes Expert Answers Via Phone

- Understand Your Tax History And Maximize Next Years Refund

PLEASE NOTE: This is for tax year 2016….This will not work on 2018 or 2017 tax year returns. Intuit Turbotax Premier 2016 [OLD VERSION] Federal andState Fed Efile PC/MAC Disc 2016 Turbo Tax Premier, perfect for investments and real estate, along with regular household tax returns. Includes state download. PLEASE NOTE: This is for tax year 2016….This will not work on 2018 or 2017 tax year returns.

Conclusion

By our suggestions above, we hope that you can found Turbotax 2018 Premier Desktop for you.Please don’t forget to share your experience by comment in this post. Thank you!

Our Promise to Readers

We keep receiving tons of questions of readers who are going to buy Turbotax 2018 Premier Desktop, eg:

- What are Top 10 Turbotax 2018 Premier Desktop for 2020, for 2019, for 2018 or even 2017 (old models)?

- What is Top 10 Turbotax 2018 Premier Desktop to buy?

- What are Top Rated Turbotax 2018 Premier Desktop to buy on the market?

- or even What is Top 10 affordable (best budget, best cheap or even best expensive!!!) Turbotax 2018 Premier Desktop?…

- All of these above questions make you crazy whenever coming up with them. We know your feelings because we used to be in this weird situation when searching for Turbotax 2018 Premier Desktop.

- Before deciding to buy any Turbotax 2018 Premier Desktop, make sure you research and read carefully the buying guide somewhere else from trusted sources. We will not repeat it here to save your time.

- You will know how you should choose Turbotax 2018 Premier Desktop and What you should consider when buying the Turbotax 2018 Premier Desktop and Where to Buy or Purchase the Turbotax 2018 Premier Desktop. Just consider our rankings above as a suggestion. The final choice is yours.

- That’s why we use Big Data and AI to solve the issue. We use our own invented, special algorithms to generate lists of Top 10 brands and give them our own Scores to rank them from 1st to 10th.

- You could see the top 10 Turbotax 2018 Premier Desktop of 2020 above. The lists of best products are updated regularly, so you can be sure that the information provided is up-to-date.

- You may read more about us to know what we have achieved so far. Don’t hesitate to contact us if something’s wrong or mislead information about Turbotax 2018 Premier Desktop.

![TurboTax Premier + State 2019 Tax Software [Amazon Exclusive] [PC/Mac Disc]](https://images-na.ssl-images-amazon.com/images/I/71s9%2BpjCP6L._AC_SL1500_.jpg)

![TurboTax Tax Software Deluxe + State 2019 [Amazon Exclusive] [PC Download]](https://images-na.ssl-images-amazon.com/images/I/71uMCoRFXkL._SL1500_.jpg)

![TurboTax Tax Software Deluxe + State 2019 [Amazon Exclusive] [Mac Download]](https://images-na.ssl-images-amazon.com/images/I/71Vv543-oAL._AC_SL1500_.jpg)

![TurboTax Premier + State 2019 Tax Software [Amazon Exclusive] [PC Download]](https://images-na.ssl-images-amazon.com/images/I/71z1kBdgThL._AC_SL1500_.jpg)

![TurboTax Premier + State 2019 Tax Software [Amazon Exclusive] [Mac Download]](https://images-na.ssl-images-amazon.com/images/I/71GoDVDefKL._AC_SL1500_.jpg)

![TurboTax Home & Business + State 2019 Tax Software [Amazon Exclusive] [PC Download]](https://images-na.ssl-images-amazon.com/images/I/71g20lTLnfL._AC_SL1500_.jpg)

![2016 Intuit Turbotax Premier 2016 [OLD VERSION] Federal andState Fed Efile PC/MAC Disc- Old Version For 2016 Taxes Only](https://images-na.ssl-images-amazon.com/images/I/61A9dCaveDL._AC_SL1000_.jpg)